June 24, 2021

What are NFTs? Top things to know before investing in them

12 min read

What are NFTs?

If you browsed any news site in the past months or just accessed social media, like the rest of us, you might have asked yourself at least once: “What are NFTs?” and why they are so talked-about in the 2021 digital landscape. In this article, we will approach the topic and cover everything you need to know about how NFTs work, what the new things are that they bring to the crypto landscape, and how the future looks for them.

What is a non-fungible token?

What does NFT mean?

NFT is short for non-fungible tokens.

These are crypto tokens generated and stored on a digital ledger (blockchain technology). Their purpose is to track the ownership of one-of-a-kind digital items, which may be anything from graphics to video footage, music, videos, tweets, virtual land, articles, or other art forms. Each NFT has its own ID and designated code, as well as other data that ensure it can’t be duplicated.

While fungible assets like cryptocurrency (Bitcoin, Ether) may be traded interchangeably, non-fungible ones may not be exchanged one for the other as they are not equivalent. If you own a Monet, for example, and someone else owns another Monet, it would not be wise to switch them, because they may have different values. The same goes for NFTs.

Why are NFTs valuable?

Non-fungible tokens have only one owner at a time. In a world that shares content at light speed, being able to claim ownership of a digital asset is extremely important, as it enables netizens to own an item that is completely theirs, but also find out to whom it belonged before and its price history, thus giving them a hint on how much it’s reasonable to pay next.

In this context, NFTs have become particularly valuable, because they enable artists to sell their unique works and offer collectors a chance to trade one-of-a-kind digital items or own a piece of something that made history.

In 2021, NFT aficionados bought algorithmically generated images, the first Tweet ever shared on Twitter, a New York Times column, an animated Gif of Nyan Cat, a 2011 meme, and many more digital items that generated a lot of enthusiasm and were much spoken about.

How are non-fungible tokens created?

NFTs are created digitally, using platforms like OpenSea, Rarible, Mintable, Makerspace, or any other marketplace available.

While they are primarily associated with Ethereum, which is the leading blockchain service for issuing non-fungible tokens, they may also be created using other blockchains, such as Binance Smart Chain, Flow by Dapper Lab, etc.

These platforms enable users to upload their creations, add a name and description and transform them into NFTs.

Moreover, a marketplace like OpenSea enables creators to add special features to their non-fungible tokens, thus increasing their scarcity and uniqueness. Items that may be added include unlockable content, viewable only by the NFT owner. This comes under different forms, from personal information to codes, discounts, etc.

When did NFTs appear?

The first-ever NFTs were actually Bitcoin Colored Coins

When people hear “NFT”, they immediately think of Ethereum, but few know that one of the first predecessors of non-fungible tokens were Bitcoin Colored Coins — small fractions of crypto (satoshis) that were marked or colored in different colors, according to specifically coded metadata. Ever since 2012, these were connected to physical assets — from actual money to company shares, houses, collectibles, etc., making them extremely valuable.

The Bitcoin Colored Coins were used for creating and trading cards, like the “Rare Pepe” ones, available on the peer-to-peer platform Counterparty.

The Rare Pepe example took advantage of a desire that was very strong in people — owning a one-of-a-kind digital asset at a time when everything may be easily copied and shared.

CryptoPunks, algorithmically-generated digital collectibles selling for millions of dollars

Following Rare Pepe, in June 2017, the American studio Larva Labs released CryptoPunks, 10,000 unique collectible characters that were generated algorithmically on the Ethereum blockchain. The 24x24 pixel images with one-of-a-kind heroes could be claimed for free, which ensured that happened quickly.

While most of the characters had human faces, some rarities existed, too — the collection included 88 Zombies, 24 Apes, and 9 Aliens. In 2021, these were bought for staggering prices, with one of the aliens making its owner $7.5 million (ETH4200) and the ape going for $1.2 million (800ETH).

2017 was also marked by the advent of CryptoKitties, a digital game that enabled players to breed, raise and engage in trading of virtual one-of-a-kind cats. The project, developed by Dapper Lab, the first recreational usage of blockchain, was extremely popular among the crypto community, generating news in titles such as CNN, CNBC, the Financial Times.

According to sources quoted by Investopedia, $40 million worth of CryptoKitties were traded on the platform, with the average price of a cat reaching $65,000.

Why do NFTs have value?

The actual process of making an NFT may cost from $0 to the equivalent of $200 in cryptocurrency. Still, in the right context, these creations can generate millions, showing that the actual value of a non-fungible token is less dependent on the cost of turning an artwork into an NFT and more on its artistic, collectible, or cultural value.

Same as physical art, NFTs also have speculative value, as they are considered investment pieces by the crypto community.

How much are NFTs worth?

According to a report released by NonFungible.com, during the first quarter of 2021, the total amount spent on NFTs surpassed $2 billion, which is 2,100% more than in 2020’s Q4. Still, $93 million worth of NFTs were sold between October and December 2020, according to the same source.

Moreover, according to Statista, in the 30 days leading up to June 15, 2021, over 93,000 non-fungible tokens were sold, most of them on the primary market.

Non-fungible digital art tokens sell for staggering prices

Non-fungible tokens are very attractive for the crypto community which is eager to own unique digital assets, thus leading to the development of a whole new industry.

Buyers have reportedly purchased different items, from songs to images, GIFs, Memes, digital collectibles, artwork, etc.

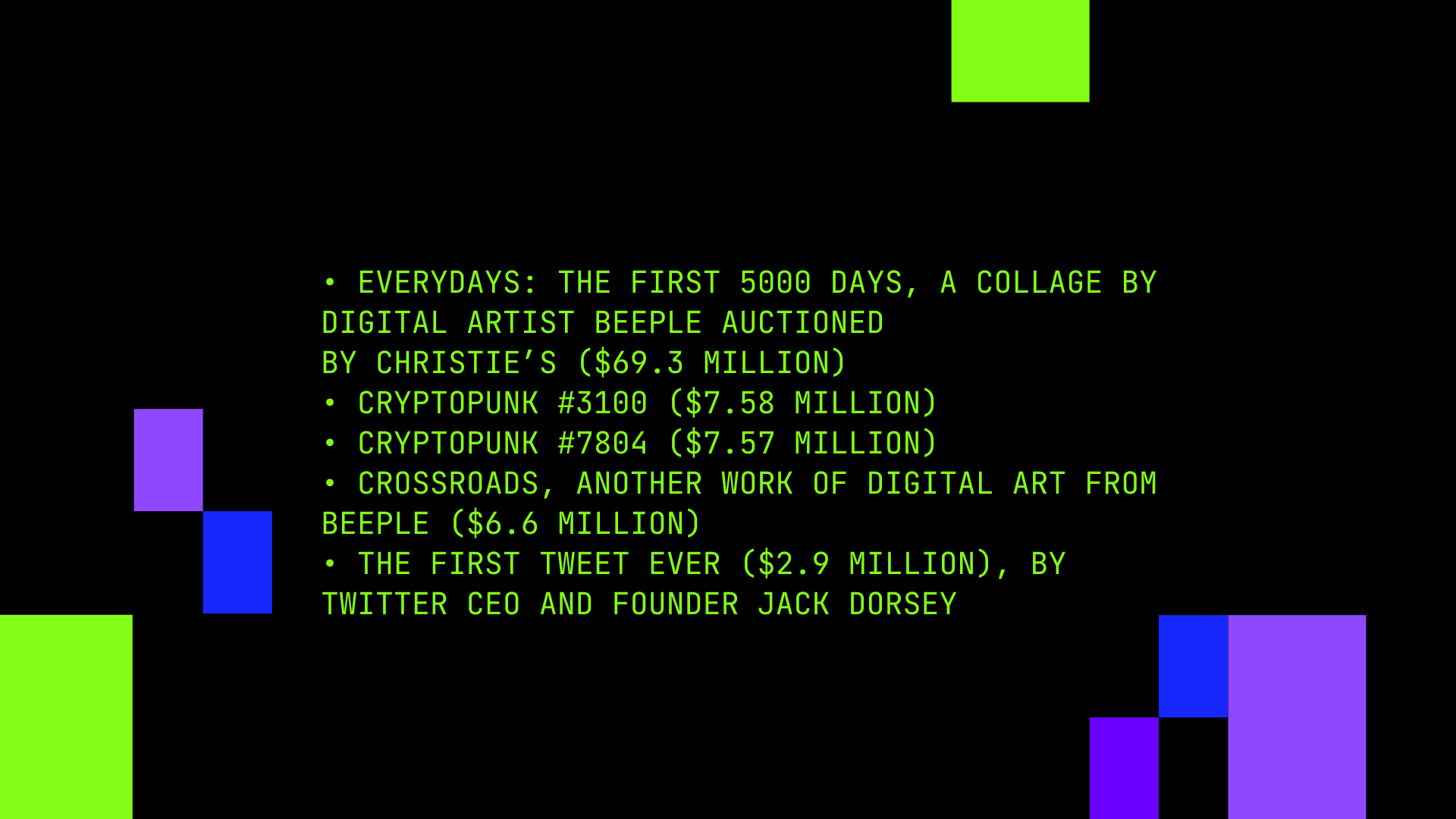

Some of the most important sales include:

- Everydays: the First 5000 Days, a collage by digital artist Beeple auctioned by Christie’s ($69.3 million)

- CryptoPunk #3100 ($7.58 million)

- CryptoPunk #7804 ($7.57 million)

- Crossroads, another work of digital art from Beeple ($6.6 million)

- The first Tweet ever ($2.9 million), by Twitter CEO and founder Jack Dorsey

In 2021, Beeple registered an NFT record with a $69.3 million sale at Christie’s

March 2021 marked a first for the crypto community. The world-renowned auction house Christie’s, an art world superpower, sold an artwork by digital artist Beeple for $69.3 million.

Titled “Everydays: The First 5000 Days”, the image combined works by Mike Winkelmann (Beeple) created daily, ever since launching his project “Everydays”, in May 2007.

While Beeple’s prints would sell for about $100, his NFTs scored significantly higher prices. His first series, for example, was sold for $66,666.66 apiece in October and resold for $6.6 million in February 2021.

The transactions sparked much discussion among blockchain enthusiasts, investors, and tech lovers, as they showcased the staggering opportunities offered by bringing together non-fungible tokens and art.

NFT ecosystem: stakeholders and usage

There is significant interest in the issue of non-fungible tokens, and the primary reason is that an NFT adds ownership and traceability to digital artworks and collectibles, making them one-of-a-kind and thus fostering a collector-friendly environment.

Who benefits from NFTs

The main stakeholders of the NFT ecosystem are the artists, the collectors, the sellers, and the buyers.

The center figure that drove the need for non-fungible tokens is the digital artist who now benefits from a solution to their life-long problem: a token that keeps an artwork safe and which differentiates the original from the copies. Years ago, an image, a song, or any other creation could be easily shared among the users and there was no way of ensuring its protection or uniqueness. As many voices strongly advised that things could not stay as they were, NFTs brought a much-needed change to this ecosystem.

Then comes the collector, the person who owns a valuable digital asset representative of a certain movement, culture, sport, community, etc. While they may not have created the actual asset, they own a scarce, desirable item.

Last but not least come the buyer and the seller. Like traditional art or collectibles, NFTs are bought either by people who want to support their favorite creators or own a piece of history or by those interested in benefiting from market fluctuations and keeping their money protected from inflation.

In 2021, NFTs have been very much treated as speculative items since a secondary market has developed around them, offering more and more people access to non-fungible tokens.

According to Statista, between May 16 and June 15, NFT sales associated with the secondary market accounted for almost a third of all non-fungible token transactions. This is a good sign in terms of their evolution, proving that there is a consistent interest in NFTs and crypto assets.

NFT top usages and industries

While they were first and foremost associated with visual art, non-fungible tokens have a significantly wider usage, as they have left their mark on several areas such as collectibles, gaming, music, etc.

NFT crypto collectibles, an investment in memorabilia

Collectibles have benefited from the NFT enthusiasm as several highlights made history.

In October 2020, Dapper Lab, the creator of CryptoKitties, launched Top Shot, a project that enables netizens to own and collect memorabilia from some of the most important moments in basketball history. The limited edition includes video, photos, visual representations of statistics and other digital visuals from key events. Moreover, Top Shot enables users to own extremely rare tokens and create sets that represent related moments, thus increasing their value as mini-series.

The Top Shot initiative has been so well received by the crypto community that in March 2021, Coin Telegraph reported that a $1 million offer was made on the #1 Jersey Match S1 Holo Zion Williamson NFT, which had been bought for $100,000 in late January 2021.

Gods Unchained is another example of digital collectible trading cards. Due to the fact that each card is unique, players may search for them and trade them, same as in the real world. According to NonFungible, in 2021, some Gods Unchained cards have been sold for thousands of dollars.

NFL player Rob Gronkowski even created his own NFT card collection which sold for over $1.6 million. The collection included 87 4-card editions, which showcased images of the player’s Super Bowl appearances, as well as one card titled “Career Highlight Refractor Card”, which sold for 232 ETH, the equivalent of $435,000, in 2021.

What dramatically boosts the rise of NFT crypto collectibles is the involvement of actors, players, and media personalities that endorse the initiatives and support the collectibles which showcase moments in which they have played a part.

NFT in-game assets, the next level for esports

Ownership of in-game assets is a new feature that NFTs have brought to the esports and gaming table. If up until their appearance, players of traditional games could only get a form of license to a certain asset, the rise of NFTs has created a system that enables proprietary rights.

Apart from ownership and provable scarcity, which may be demonstrated through the records embedded in each NFT, there are other attributes of owning NFT in-game assets that are very specific to the industry of esports and gaming.

One is that they are characterized by interoperability, which means that they may be shared across different decentralized games, made on the same blockchain technology. A player which purchases a certain character, armor, or other assets may switch them from one game to another.

What’s more, NFT game assets are independent of specific gaming and esports platforms, which means that, if the game ever closes or shuts down, players still have access to their assets and may thus use them in different games.

The above characteristics foster the growth of the gaming and esports economy, fueling the development of new games.

Some of the most popular NFT in-game assets include plots of land sold in Axie Infinity, a blockchain-powered game. 9 plots here have sold for $1.5 million.

Moreover, in March 2021, the F1® Delta Time “70th Anniversary Edition” Apex race car non-fungible token (NFT) sold for 987,000 REVV — the equivalent of approximately US$265,000 at the time of sale.

The music business also embraces NFT

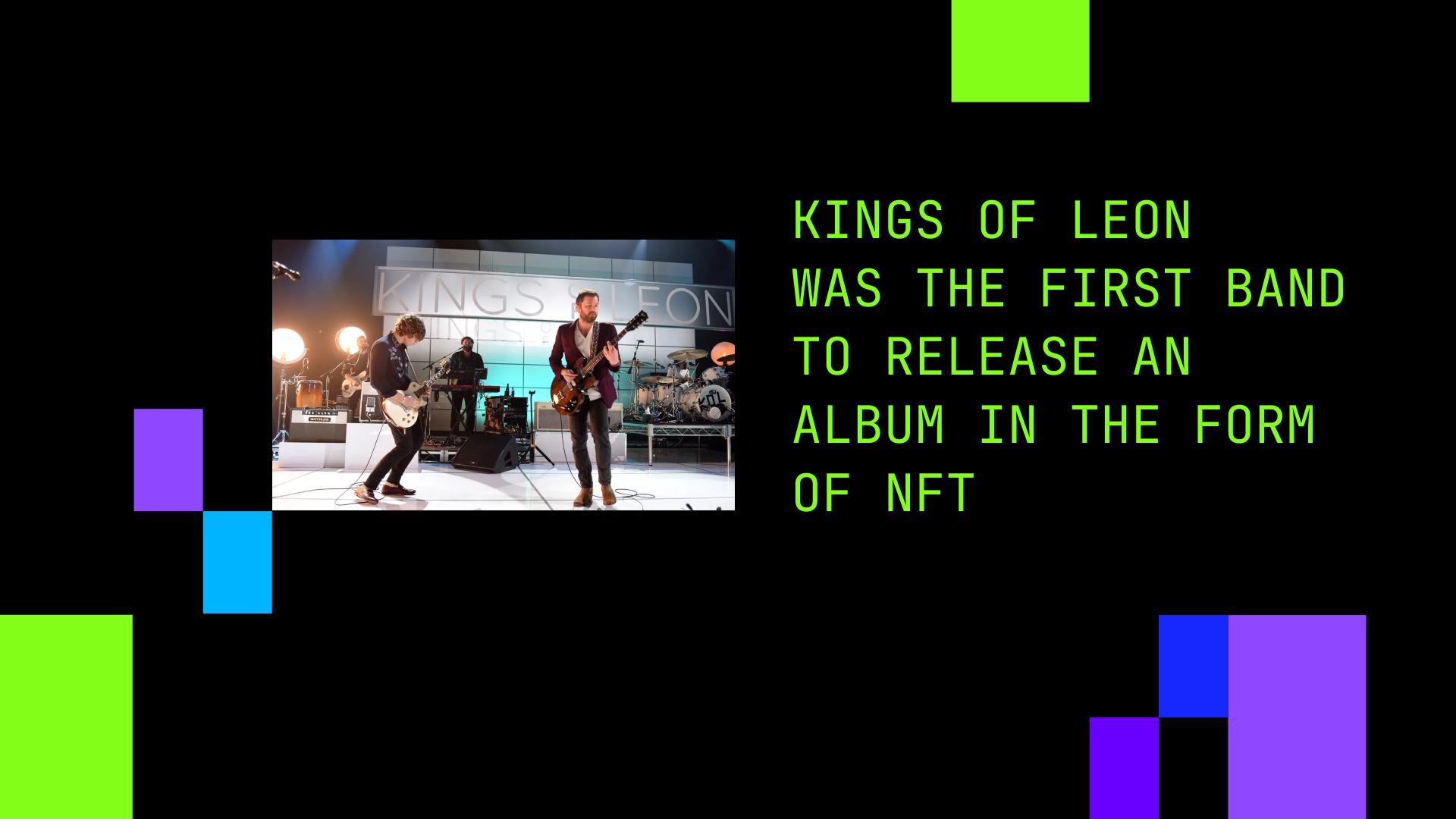

Purchasing music is also possible in the NFT ecosystem. In March 2021, Kings of Leon was the first band to release an album in the form of NFT. A buyer could benefit from special packages or from concert perks depending on what they choose, as well as from visual art.

Moreover, even Elon Musk joined the game, mentioning on his Twitter that he was selling a techno track he produced as an NFT.

Usages of NFT also include fashion and intellectual property

An innovator in its industry, Nike patented CryptoKicks, a system that enables customers the option of authenticating physical sneakers, offering them digital versions of their products that may be transferred together with the actual physical asset. This enables secondary market buyers to know more about the products and their ownership over time.

Non-fungible tokens are used to protect different forms of intellectual property. An example is the New York Times column that has been sold as an NFT on the site.

NFT’s potential as investment

Like all investments, NFTs are also risky, since they depend on a very complex ecosystem and on the existing demand. Still, figures prove that adopters may benefit greatly from this emerging trend.

Choosing in which to invest is a difficult decision, similar to investing in traditional art and collectibles. Criteria should include making choices based on the pleasure derived from and appreciation for something — you want the NFT you buy to actually mean something for you or provide a sense of satisfaction, — as well as on analyzing the evolution of the demand and the factors influencing it.

The fact that names outside the crypto community such as Michael Jordan, Alex Caruso, Kevin Durant, Will Smith, or the Chernin Group have participated in a recent Dapper Lab funding round which managed to raise $305 million is a sign that interest in NFTs is maturing.

Be a part of the esports community with WePlay Collectibles

WePlay Collectibles enable you to become an engaged part of an esports event and support players and talent by purchasing NFT memorabilia and rewards associated with certain tournaments.

WePlay Collectibles contribute to prolonging the engagement of esports events, thus ensuring that the immersive experience continues after the competition ends and taking it beyond the actual venue. Through the combination of real-world experiences and technology, esports are brought to a new level.

Our WePlay Collectibles collections include tournament cards with digital tournament logos and other official elements, personality cards that bear images or signatures of players, coaches, commentators, or other key people, team cards similar to personality cards, but with the whole teams, as well as highlights, digital media — images, video, 3D holograms, etc. — with key competition moments.

This feature has been written for educational purposes only. The images have been added to it for clarity. WePlay Esports does not sell or use third-party IP to create NFTs.